The best corporate training apps in 2026 include platforms like Docebo, TalentLMS, Absorb LMS, SAP SuccessFactors Learning, and Cornerstone, each with different strengths in scale, analytics, integrations, and admin control.

When I talk to enterprise teams comparing corporate training apps, the problem is whether the platform can scale without breaking adoption, reporting, or integrations. Slide decks, workshops, and legacy LMS tools fail once headcount grows, teams globalize, or compliance becomes non-negotiable.

The best corporate training apps solve this by combining mobile-first learning, role-based delivery, analytics, and HR/LMS integrations into a single system. That’s why enterprises prioritize them.

According to LinkedIn’s Workplace Learning insights, 88% of organizations see retention as a critical risk, with learning and development as the top strategy to address it.

This comparison focuses on which corporate training apps actually hold up at scale, and where each one fits best.

Key Takeaways

- The best corporate training apps for mid-to-large companies are Docebo, SAP SuccessFactors Learning, Cornerstone, Absorb LMS, and TalentLMS, each suited to different scale, compliance, and integration needs.

- SaaS platforms are faster to launch, but custom training apps scale better long-term when analytics, workflows, and data ownership matter.

- Key features to prioritize: mobile-first microlearning, role-based learning paths, decision-grade analytics, and enterprise-level security.

- Costs diverge at scale: SaaS pricing compounds with headcount, while custom builds have higher upfront cost but lower long-term TCO.

- Most failures come from architecture and integrations, not missing features, like systems that isolate analytics, scale media independently, and integrate cleanly hold up as teams grow.

Best Corporate Training Apps

The best corporate training apps for mid-to-large companies are Docebo, SAP SuccessFactors, Cornerstone, Absorb LMS, and TalentLMS, because they consistently support scale, integrations, and operational reliability beyond pilot deployments.

When I evaluate corporate training apps for companies with 200 to 5,000+ employees, I don’t look at feature lists first.

I look at where systems fail after rollout: onboarding spikes that break performance, analytics that can’t answer leadership questions, integrations that require constant workarounds, and learning experiences employees quietly abandon.

According to the World Economic Forum, 39% of workers’ core skills are expected to change by 2030, forcing organizations to rethink how fast and flexible training systems can evolve.

Corporate training apps that can’t support rapid updates, role-based learning, and measurable outcomes quickly become blockers instead of enablers.

Below is how the leading platforms actually perform when used at scale.

1. Docebo

Docebo is often chosen by fast-growing SaaS and technology companies that need learning systems to evolve quickly. Its strength lies in handling complex learning paths, automation, and personalization without becoming operationally heavy.

At scale, Docebo performs well in environments where learning content changes frequently, like product updates, sales enablement, compliance refreshers, and role-based onboarding.

Its analytics capabilities go beyond completion rates, making it easier for leadership teams to understand engagement and skill coverage.

Where teams struggle is customization depth. When organizations need proprietary workflows, deeply custom dashboards, or non-standard learning logic, they often extend Docebo with custom components.

Best fit: SaaS, tech, and product-led companies with frequent training updates

Watch out for: Advanced customization requires external development

2. SAP SuccessFactors Learning

SAP SuccessFactors Learning is typically selected by large enterprises that already run SAP across HR, finance, or operations. Its biggest advantage is ecosystem alignment, like identity, reporting, compliance, and governance all sit within an enterprise-grade framework.

This platform excels in regulated industries, global organizations, and environments where compliance reporting and auditability matter more than UX polish. It scales reliably across regions and large employee populations.

The downside is flexibility. Teams looking for modern learning experiences or rapid iteration often find SuccessFactors rigid. Many enterprises use it as the system of record for training, while layering modern learning experiences on top using custom development.

Best fit: Enterprises with SAP-centric HR and compliance needs

Watch out for: Slower iteration and limited UX flexibility

3. Cornerstone

Cornerstone is widely used in industries where learning paths, certifications, and compliance requirements are non-negotiable. It handles complex hierarchies, role-based permissions, and audit-ready reporting well.

For organizations running long-term capability programs, leadership development, regulated training, certification tracking, Cornerstone provides stability and depth. It scales well, but implementation and configuration often require careful planning and experienced partners.

The trade-off is speed. Cornerstone is not optimized for rapid experimentation or lightweight onboarding experiences. Teams prioritizing agility often combine it with custom tools built externally.

Best fit: Regulated industries, enterprise L&D programs

Watch out for: Heavier setup and longer time to value

4. Absorb LMS

Absorb LMS is frequently chosen by mid-to-large organizations that want a balance between enterprise features and faster deployment. It supports integrations, analytics, and scalability without the complexity of full enterprise suites.

In practice, Absorb works well for companies modernizing away from legacy LMS tools. It handles onboarding, internal training, and partner education effectively, especially when teams want predictable administration and reporting.

Its limitation appears when organizations need highly differentiated learning experiences or product-like behavior. At that point, custom extensions become necessary.

Best fit: Mid-market to upper-mid enterprises seeking speed and stability

Watch out for: Limited flexibility for highly bespoke learning models

5. TalentLMS

TalentLMS is often adopted by growing teams that need to move fast without enterprise overhead. It offers solid core LMS functionality, straightforward integrations, and relatively quick implementation.

For SaaS teams scaling from 100 to 500 employees, TalentLMS can be a practical choice. However, as organizations grow beyond that, reporting depth, customization, and multi-tenant complexity can become constraints.

Best fit: Growing companies prioritizing speed and simplicity

Watch out for: May require replacement or extension at larger scale

Feature Comparison: Scalability, Integrations, Analytics

| App |

Scalability for 500–5,000+ employees |

Integrations (SSO, HRIS, content, APIs) |

Analytics depth (beyond completions) |

Best-fit signal |

| SAP SuccessFactors Learning |

Strong (enterprise HR ecosystem) |

Strong inside SAP/HCM stacks |

Strong for enterprise reporting |

HR suite standardization |

| Cornerstone |

Strong (regulated/enterprise) |

Strong (often partner-led) |

Strong (enterprise L&D focus) |

Compliance-heavy orgs |

| Docebo |

Strong (enterprise learning tech) |

Strong (learning tech ecosystem) |

Strong (AI + personalization narrative) |

Scale + modern learning ops |

| Absorb LMS |

Strong (corporate training emphasis) |

Strong (common corporate stack) |

Strong (admin + reporting focus) |

Faster rollout + ops efficiency |

| TalentLMS |

Good (mid-market to upper mid) |

Good (practical integrations) |

Moderate-strong (depends on plan) |

Lean teams that need speed |

If you need custom workflows (role-based training triggers, multi-tenant experiences, proprietary analytics, or deep integration logic), the winning pattern is often platform + extensions, build the differentiators around the LMS with an elearning app development company, instead of forcing the LMS to become your product.

Not sure which corporate training app actually fits your scale?

Get an independent technical review of your training requirements, covering platform fit, integration risks, cost at scale, and whether SaaS or custom makes more sense for your organization.

Get a Fit Assessment

What Key Features Should Enterprises Evaluate When Comparing Corporate Training Apps?

The key features enterprises should look for in corporate training apps are mobile-first delivery, intelligent personalization with analytics, and enterprise-grade security with centralized user management.

After evaluating training platforms in real environments, I’ve learned this: most tools lack features, because they don’t align with how modern teams actually work.

Enterprise training today is continuous, distributed, and data-driven. If a platform can’t adapt to that reality, adoption drops fast, no matter how strong the content is.

Below are the features that consistently separate platforms that scale from those that stall.

Mobile-First & Microlearning

Enterprise training apps must be designed for how employees consume learning today: on mobile, in short sessions, and between real work.

From experience, platforms that rely on long-form desktop courses see lower completion and engagement rates as teams grow.

Mobile-first design enables just-in-time learning, such as short modules, quick refreshers, and contextual training tied to real workflows. Microlearning also makes content easier to update, which is critical when products, compliance rules, or processes change frequently.

What to check

- Native or responsive mobile experience

- Short, modular content formats

- Offline or low-bandwidth support for global teams

AI-Driven Learning Paths & Analytics

This shift reflects how AI in edtech is being applied today, not as a novelty, but to make learning paths more relevant, measurable, and responsive to real user behavior.

At scale, manual learning paths don’t work. The strongest corporate training apps use AI to adapt learning based on role, behavior, and progress, while giving leadership visibility into outcomes.

In practice, analytics matter more than automation. Completion rates alone are meaningless. What decision-makers need is insight into skill coverage, learning velocity, and gaps by role or team.

When platforms fall short here, organizations often supplement them with custom dashboards built through AI app development or external data pipelines.

What to check

- Role-based or adaptive learning paths

- Cohort and skill-level analytics

- Exportable data or API access

Security, Compliance, and User Management

For enterprises, training apps are no longer “tools”—they are systems of record. That makes security and access control non-negotiable.

Based on long-term deployments, the biggest risks appear during growth: inconsistent permissions, weak identity management, and limited audit trails.

Platforms must support enterprise SSO, role-based access, compliance reporting, and data governance from day one.

What to check

- SSO, SCIM, and role-based permissions

- Compliance reporting and audit logs

- Data isolation for multi-team or multi-region use

If a corporate training app doesn’t meet all three areas, like delivery, intelligence, and governance, it will eventually slow the organization down. This is often the point where enterprises extend platforms with custom components or replace them entirely to regain control at scale.

Should Enterprises Build a Custom Corporate Training App or Buy an Off-the-Shelf Platform?

You should build a custom corporate training app when off-the-shelf platforms start limiting scale, integrations, data ownership, or learning logic, and buy when speed and standardization matter more than differentiation.

After decades of working with enterprise training systems, I’ve seen this decision repeat itself across SaaS, EdTech, and large organizations. Teams usually start by buying. It’s faster, cheaper upfront, and “good enough” early on. The problem appears later, when training becomes tied to performance, compliance, and business outcomes.

The real question isn’t build or buy. It’s when buying stops working.

When Off-the-Shelf Platforms Break

Most corporate training platforms fail quietly, not catastrophically. The cracks show up as workarounds.

Common breakpoints I see:

- Reporting can’t answer leadership questions beyond completions

- Integrations with HRIS, product, or analytics become brittle

- Learning paths don’t adapt to role changes or scale

- UX friction lowers adoption as teams grow

- Vendor roadmaps lag behind business needs

At this stage, teams spend more time managing the platform than enabling learning. That’s usually the signal that the tool is no longer aligned with the organization’s operating model.

When Custom Development Makes Sense

Custom development makes sense when training becomes infrastructure, not tooling.

From experience, building a custom corporate training app is justified when:

- Training logic is tightly coupled with internal workflows

- Learning data must integrate deeply with business systems

- You need full control over analytics, permissions, and content models

- Scale, multi-tenancy, or regional rules exceed SaaS limits

- Training is a competitive or operational differentiator

Many enterprises take a hybrid path, keeping a core LMS while building custom layers around it. Done right, this delivers speed without sacrificing control.

Expert takeaway:

Buy to validate. Build when training becomes mission-critical. The costliest mistake isn’t building too early—it’s staying locked into platforms that can’t grow with the business.

How Much Does It Cost to Build a Corporate Training App Compared to SaaS Pricing Over Time?

SaaS corporate training platforms are cheaper to start; custom corporate training apps are cheaper to own once scale, integrations, and control matter.

That’s the real comparison enterprises miss.

Below is a practical, apples-to-apples breakdown based on how these systems behave in real organizations, not brochure pricing.

SaaS Corporate Training Apps: Real Pricing vs Real Capabilities

Most enterprises evaluating SaaS options end up shortlisting platforms like Docebo, Cornerstone, SAP SuccessFactors, Absorb LMS, and TalentLMS.

Typical SaaS Pricing (Enterprise Reality)

| Platform |

Public / Market Pricing Range |

What’s Included |

What’s Extra or Limited |

| Docebo |

~$6–$10/user/month |

Core LMS, basic analytics, AI recommendations |

Advanced reporting, integrations, customization |

| Cornerstone |

Custom (often $8–$15/user/month equivalent) |

Compliance, certifications, reporting |

UX flexibility, speed, customization |

| SAP SuccessFactors |

Enterprise contract (bundled) |

HR-aligned learning, compliance |

Agility, modern UX, fast changes |

| Absorb LMS |

~$6–$12/user/month |

Corporate LMS, reporting |

Deep customization, proprietary workflows |

| TalentLMS |

~$4–$8/user/month |

Fast setup, core LMS |

Scale, advanced analytics, multi-tenant logic |

What SaaS Does Well

- Fast rollout (weeks, not months)

- Predictable upfront cost

- Maintenance handled by vendor

- Works well for standardized training

Where SaaS Breaks at Scale

- Cost compounds linearly with headcount

- Limited control over analytics and data models

- Integrations become brittle or expensive

- Learning logic must fit vendor constraints

- Roadmap dictated by vendor, not business

At 3,000 employees, even a modest $7/user/month SaaS plan becomes $252,000 over three years, before add-ons, integrations, or admin overhead.

Custom Corporate Training App: Cost vs Control

A custom corporate training app follows a fixed build cost + predictable operating cost model. This is where education app development cost becomes a strategic discussion, not just a budget line.

Realistic Custom Build Cost by Capability

| Capability |

Custom Build Cost |

What You Get |

| Authentication, SSO, roles |

$10k–$25k |

Full control, enterprise IAM |

| Course & content management |

$20k–$50k |

Custom learning models |

| Video & media delivery |

$15k–$40k |

Optimized for your usage |

| Assessments & certifications |

$15k–$35k |

Business-specific logic |

| Advanced analytics & dashboards |

$20k–$45k |

Role- and skill-based insights |

| HRIS / LMS / API integrations |

$20k–$60k |

Tight system alignment |

| Security, audit, compliance |

$15k–$40k |

Ownership + governance |

Total realistic range:

- Mid-scale enterprise: $80k–$150k

- Large enterprise / multi-region: $200k–$400k+

What Custom Does Better

- No per-user licensing tax

- Full data ownership

- Learning logic matches workflows

- Analytics tied to business KPIs

- Easier long-term evolution

Where Custom Requires Discipline

- Higher upfront investment

- Requires product ownership

- Needs clear scope and roadmap

Which (SaaS vs Custom) Delivers More ROI

| Dimension |

SaaS Training Platforms |

Custom Corporate Training App |

| Upfront cost |

Low |

Medium–High |

| Cost at scale |

High (recurring) |

Stable |

| Custom workflows |

Limited |

Full |

| Analytics depth |

Vendor-defined |

Business-defined |

| Integrations |

Add-ons / constraints |

Native & flexible |

| Data ownership |

Vendor-controlled |

Fully owned |

| Long-term ROI |

Declines with scale |

Improves with scale |

Choose SaaS if training is standardized, headcount is stable, and speed matters more than control.

Choose custom when training affects performance, compliance, or revenue—and when scale makes per-user pricing inefficient.

The biggest mistake isn’t building too early. It’s paying SaaS pricing for years while bending your operations to fit someone else’s product.

This is where education app development cost becomes a strategic consideration, especially when long-term scalability, integrations, and data ownership start outweighing short-term licensing convenience.

What Architecture Is Required to Scale a Corporate Training App to Thousands of Users?

The recommended architecture for scalable corporate training apps is a modular, cloud-native system that separates learning delivery, analytics, and integrations, so the platform can scale to thousands of users without performance or reporting failures.

From decades of hands-on work, this is where most training platforms either hold up, or quietly collapse. Features don’t break first. Architecture does. Especially during onboarding spikes, global rollouts, or compliance audits.

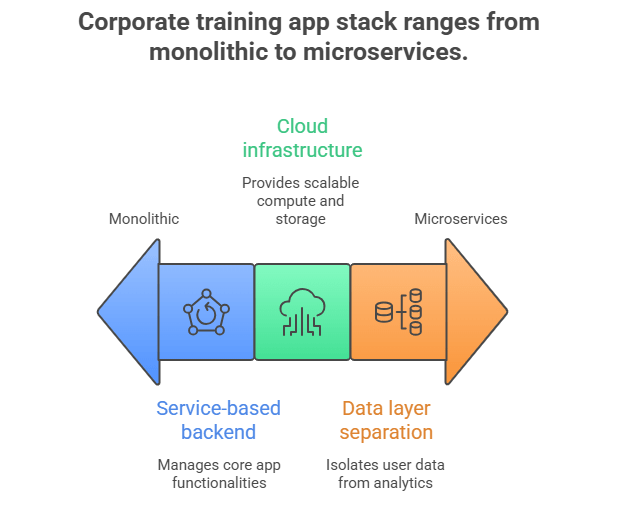

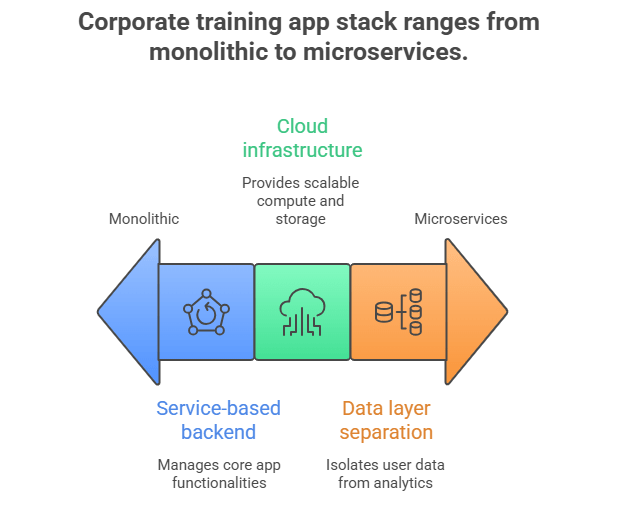

Backend, Cloud, and Data Stack

At scale, corporate training apps must handle bursty traffic, media-heavy workloads, and analytics queries without slowing learners down.

A proven backend setup looks like this:

-

Service-based backend (modular monolith or microservices)

-

Cloud infrastructure (AWS / Azure / GCP)

-

Auto-scaling compute for onboarding waves

-

Object storage + CDN for video and content

-

Managed databases for reliability

-

Data layer separation

-

Relational DB for users, permissions, progress

-

Analytics/event store for learning activity

Cost reality:

The biggest architectural mistake I see is mixing reporting and user traffic in the same data layer. That’s what causes timeouts and “slow LMS” complaints.

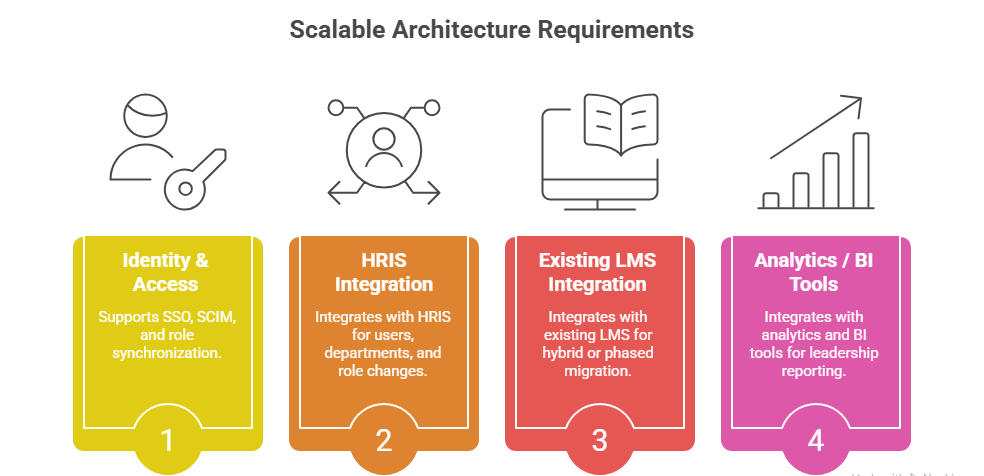

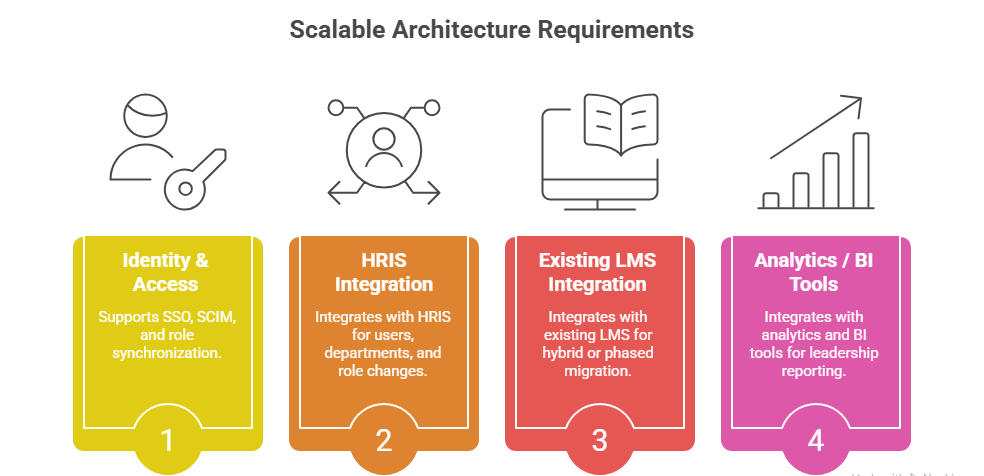

Integrations with LMS, HRIS, Analytics

At enterprise level, training apps are never standalone systems.

A scalable architecture must support:

-

Identity & access (SSO, SCIM, role sync)

-

HRIS integration (users, departments, role changes)

-

Existing LMS (for hybrid or phased migration)

-

Analytics / BI tools (leadership reporting)

From experience, integrations, not features, drive long-term cost. Fragile or undocumented APIs lead to constant fixes, manual syncs, and reporting disputes.

Integration cost reality:

-

Basic HRIS + SSO integration: $10k–$20k

-

Multi-system sync (HRIS + LMS + BI): $25k–$60k

-

Ongoing maintenance: 10–15% of initial build annually

Teams that underinvest here usually pay more later in workarounds.

Expert Takeaway

Scalable corporate training apps aren’t built around courses. They’re built around systems behavior under growth.

If your architecture:

-

isolates analytics from learning traffic

-

scales media independently

-

treats integrations as first-class components

you avoid the rebuild most enterprises face at 2–3× growth.

This is the difference between a training platform that supports the business, and one that becomes technical debt the moment headcount accelerates.

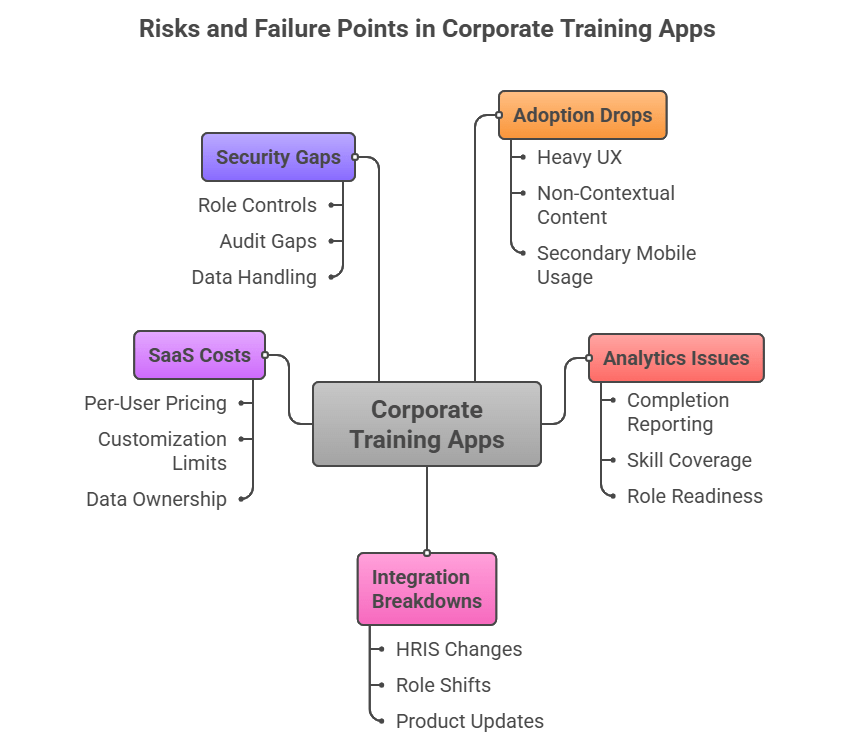

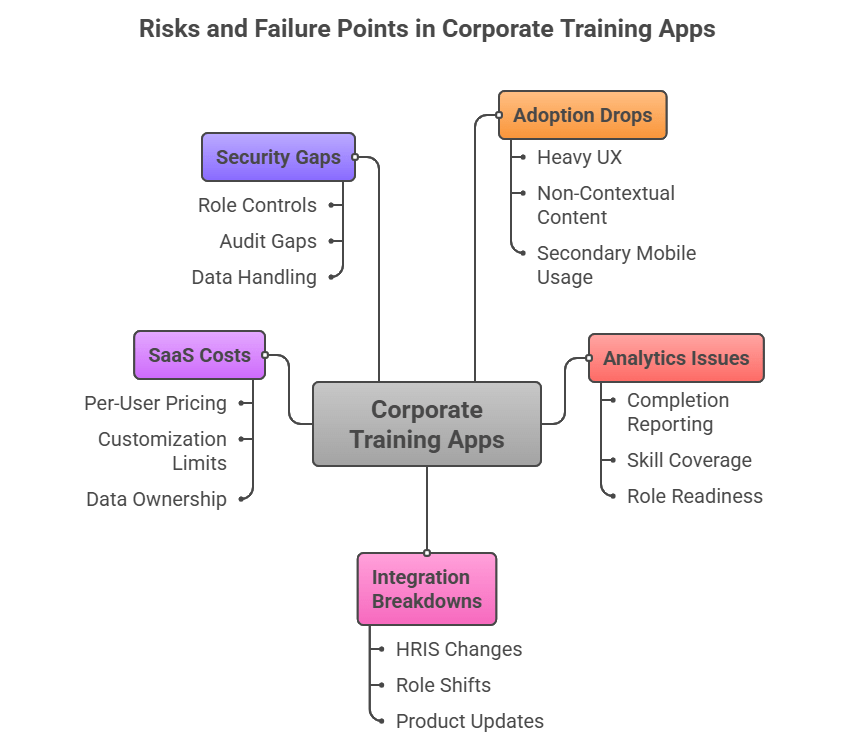

What Are the Biggest Risks and Failure Points with Corporate Training Apps at Scale?

The biggest risks with corporate training apps are low adoption, brittle integrations, shallow analytics, and escalating long-term costs once the platform hits real scale.

After decades of auditing training systems, failures almost never come from missing features. They come from misalignment between the platform and how the business actually operates. Below are the failure points I see most often, and what they really cost.

1) Adoption Drops After Initial Rollout

Training apps often launch strong and fade fast. Employees disengage when UX is heavy, content isn’t contextual, or mobile usage feels secondary.

Hidden cost:

If adoption isn’t designed in from day one, no feature set fixes it later.

2) Analytics That Don’t Answer Executive Questions

Many platforms report completions, but can’t show skill coverage, role readiness, or learning impact. Leadership asks questions the system can’t answer.

Hidden cost:

This is where teams realize training data isn’t decision-grade.

3) Integrations Break as Systems Evolve

HRIS changes, roles shift, products update. Training apps with weak APIs or rigid schemas start desyncing users, permissions, and progress.

Hidden cost:

Most replacements happen because integrations rot, not because features are missing.

4) SaaS Costs Outpace Value at Scale

Per-user pricing feels manageable until headcount grows. Add analytics, compliance modules, and integrations, and costs accelerate.

Real-world impact:

This is where SaaS becomes an operational tax.

5) Security and Access Gaps Appear Too Late

Training apps quietly become systems of record. Weak role controls, audit gaps, or region-specific data handling issues surface during audits, not demos.

Hidden cost:

Security added late is always more expensive.

Many of these issues reflect broader challenges in education app development, particularly when platforms are designed for content delivery rather than operational scale.

Most corporate training app failures are predictable. They happen when platforms are selected for speed, not scale, and never re-evaluated as training becomes business-critical.

Why Choose AppVerticals for Building a Corporate Training App?

AppVerticals has real experience building enterprise-grade learning and training platforms that go beyond typical LMS constraints.

A prime example is the Nokia Al-Saudia Training Center platform, where AppVerticals engineered a unified digital learning system that automated course enrollment, certification, scheduling, and hybrid delivery for over 10,000 learners across telecom, AI, and IT training, helping the organization scale training operations far beyond manual tools.

This case shows how custom learning systems, the sort AppVerticals specializes in alongside education app development services, can transform fragmented training workflows into scalable, measurable, and enterprise-ready systems.

Partnering with experts like AppVerticals can make the difference between a training tool that “works for now” and one that becomes the backbone of organizational learning strategy.

Wrapping it Up

Choosing the right corporate training app is a strategic decision that affects performance, retention, and long-term operational effectiveness. Off-the-shelf SaaS solutions like Docebo, SAP SuccessFactors Learning, Cornerstone, Absorb LMS, and TalentLMS are excellent starting points for many organizations.

But as training becomes mission-critical, scalability, integrations, and analytics drive the need for custom solutions that align with your workflows and data ownership requirements.

The decision isn’t just build or buy. It’s about where your organization will be in 12–36 months, and which system can grow with you without becoming technical debt.

Planning to scale training beyond what off-the-shelf platforms allow?

Work with engineers who design corporate training systems around real workflows, analytics, and long-term scalability, not demos.

Get an Expert Help

ChatGPT

ChatGPT

Perplexity

Perplexity

Google AI

Google AI