About Us

The best AI tools for real estate agents are Follow Up Boss and kvCORE for CRM automation, Salesforce Einstein for enterprise lead scoring, and HouseCanary for investor valuation modeling.

AI adoption in real estate isn’t hype. According to the National Association of REALTORS®, more than 60% of realtors are now using AI tools in their business operations, with ChatGPT, Google’s Gemini, and Microsoft Copilot among the most cited.

After evaluating these tools across brokerages, proptech teams, and investor workflows, one pattern is clear: Integration, data quality, and measurable ROI matters more than features.

Some tools reduce manual follow-ups. Others collapse under scale once MLS sync and CRM automation become complex.

In this guide, I break down which AI tools actually hold up in production, where free platforms make sense, and when building custom AI becomes the smarter long-term move.

An AI tool is “best” only if it integrates with MLS in real time, automates follow-ups without manual triggers, and improves measurable KPIs like response time and cost-per-lead.ng.

Most AI failures in brokerages happen because lead scoring is deployed without automated routing logic.

The difference comes down to integration depth, data quality, workflow automation, and measurable ROI.

According to McKinsey, 65% of organizations now use generative AI regularly in at least one business function, but only a fraction report measurable bottom-line impact.

In real estate, that gap shows up when AI generates content but doesn’t sync with MLS, when lead scoring exists but doesn’t trigger CRM workflows, or when valuation models lack localized data.

The best tools don’t sit on top of operations, they become embedded into them.

In many cases, achieving that level of integration requires structured real estate software development services that align CRM systems, MLS data feeds, automation workflows, and predictive models into a cohesive operational layer.

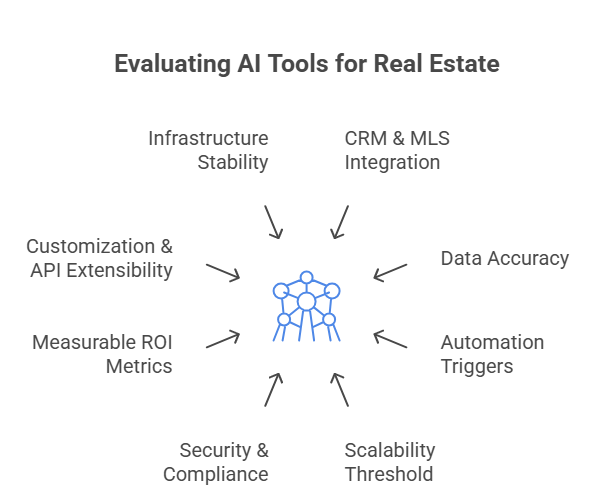

When evaluating AI tools for real estate, I focus on operational fit, scalability, and financial impact, not feature lists.

Here’s the checklist that consistently separates scalable AI platforms from short-lived experiments:

From what I’ve seen across brokerages and proptech teams, the tools that survive long-term are the ones that reduce inside sales costs, automate valuation workflows, and maintain data integrity at scale, not the ones with the flashiest AI features.

The AI tools that consistently improve real estate lead conversion within six months are Salesforce Einstein, HubSpot AI, and Ylopo, because they combine predictive lead scoring, automated outreach, and CRM-triggered workflows into one operational system.

These platforms don’t just “assist.” They automate response logic, prioritize high-intent buyers, route leads instantly, and trigger follow-ups across email, SMS, and calling systems.

According to Harvard Business Review, companies that respond to leads within an hour are nearly 7 times more likely to qualify them compared to slower responders.

Speed-to-lead is where AI delivers immediate ROI. In brokerages handling hundreds of inquiries daily, automation eliminates response delays and reduces inside sales overhead.

Where I’ve seen real impact is when AI compresses response time from hours to seconds.

Best For: Enterprise brokerages with structured CRM data

In enterprise brokerages where I’ve tested Einstein, its performance depends entirely on CRM discipline. When pipeline stages are standardized and agent activity is logged consistently, the predictive scoring genuinely improves prioritization and forecasting.

But in messy CRM environments, accuracy drops fast because the model trains on bad data. It’s powerful in structured 200+ agent Salesforce ecosystems.

Limitation: Requires clean historical data and Salesforce ecosystem

Best For: Growth-stage brokerages and inbound-heavy teams

From my experience, HubSpot AI delivers faster time-to-value for inbound-driven brokerages. Its automation workflows and lead nurturing sequences are easy to operationalize, and you can see engagement improvements quickly.

However, once MLS-triggered routing or complex brokerage hierarchies enter the picture, customization becomes necessary. It works best for marketing-heavy teams, not deeply MLS-dependent brokerages.

Limitation: Less native MLS depth compared to real estate-specific tools

Best For: Teams heavily invested in paid ads

Ylopo performs well when paid traffic volume is strong. I’ve seen its behavioral retargeting increase re-engagement significantly in ad-heavy environments.

But its scoring accuracy weakens when lead volume or traffic quality drops. It’s an acquisition amplifier, not a foundational CRM.

Best layered on top of a structured system, not used as the core operational engine.

Limitation: Performance tied directly to ad budget quality

| Tool | Best For | Deployment Speed | ROI Timeline | Core Strength | Primary Limitation |

|---|---|---|---|---|---|

| Salesforce Einstein | Enterprise brokerages (200+ agents) with structured CRM data | 6–8 weeks | 3–6 months | Advanced predictive lead scoring & revenue forecasting | Requires clean CRM data and Salesforce ecosystem |

| HubSpot AI | Growth-stage brokerages focused on inbound marketing | 2–4 weeks | 2–4 months | Fast marketing automation & lead nurturing workflows | Limited native MLS depth without customization |

| Ylopo | Teams running large paid ad budgets | 4–6 weeks | 3–5 months | Behavioral retargeting & AI-driven digital nurture campaigns | ROI highly dependent on traffic quality |

In real estate deployments, ROI usually unfolds in phases:

0–60 Days: CRM integration, MLS syncing, workflow automation setup

60–120 Days: Measurable reduction in manual lead handling (often 30–50%)

3–6 Months: Increased qualification rates and lower cost per lead

Follow Up Boss is best for workflow speed, kvCORE for behavioral tracking, and Lofty for paid lead environments.

They combine IDX/MLS syncing, automated lead routing, behavioral tracking, and AI-driven follow-up inside one operational workflow.

These platforms are purpose-built for real estate. They don’t just sit on top of your CRM, they connect directly to MLS feeds, trigger automations when listings update, and score leads based on search behavior and engagement history.

From what I’ve seen across mid-sized brokerages, the real performance gains come when AI triggers action automatically, text messages, task assignments, call reminders, without requiring manual intervention.

In real deployments, Follow Up Boss performs best when a brokerage is juggling multiple lead sources at once.

I’ve seen it significantly reduce response lag because routing rules are simple, fast, and reliable. Where it really works is in speed-to-lead environments. But it’s workflow automation, not predictive intelligence.

If you’re looking for deep behavioral modeling or valuation analytics, it won’t give you that layer.

Limitation: It doesn’t provide deep predictive valuation or market forecasting. It’s workflow AI, not property intelligence AI.

kvCORE becomes powerful when IDX behavior is actually used as signal, not just stored data. In brokerages that enforce structured workflows, its property-view tracking and automated alerts create meaningful follow-up precision.

However, I’ve also seen it become cluttered when teams don’t maintain discipline. It’s strong for multi-team brokerages, but onboarding and governance determine whether it scales cleanly or becomes heavy.

Limitation: Setup requires structured onboarding. Without disciplined team usage, it becomes bloated.

Lofty works best in aggressive digital acquisition environments. When traffic volume is high, its behavioral scoring starts to differentiate serious buyers from casual browsers.

I’ve seen it perform well when paired with paid ads and structured landing funnels. But without consistent lead inflow, the AI lacks enough behavioral data to create strong prioritization.

It’s a growth accelerator, not a low-volume optimization tool.

Limitation: If traffic volume is low, AI scoring doesn’t get enough signal to differentiate serious buyers.

| Tool | Best For | MLS / IDX Integration Depth | Automation Strength | Ideal Brokerage Size | Key Limitation |

|---|---|---|---|---|---|

| Follow Up Boss | Speed-to-lead & portal routing | Strong MLS sync + portal lead routing | High – automated tasking, SMS, email triggers | 50–300 agents | Limited predictive valuation & forecasting |

| kvCORE | Behavioral tracking & IDX-driven automation | Deep IDX + property search tracking | High – behavior-based alerts & nurture flows | 100–500 agents | Requires structured onboarding & team discipline |

| Lofty (Chime) | Paid lead environments & digital acquisition | Strong IDX + landing page integrations | Moderate–High – scoring tied to engagement depth | Growth-focused brokerages | Needs strong ad volume to maximize AI accuracy |

Free AI tools are effective for drafting and research but unsafe for transaction-level data or CRM automation.

The best free AI tools that are meaningfully relevant to real estate agents are ChatGPT (free tier), Google Gemini (free), Zillow Zestimate (free valuation model), and Reonomy’s limited search access (trial/free tiers), and even these have operational limits.

Free tools can assist with research, valuation estimation, content drafting, and market analysis. But none of them replace CRM automation, MLS integration, or secure transaction management.

Free AI tools can help real estate agents move faster, but they don’t replace CRM systems, MLS automation, or brokerage infrastructure.

I’ve seen agents use them effectively for research, listing prep, and early-stage deal analysis, but I’ve also seen teams overestimate what “free” can realistically handle.

I’ve seen agents use ChatGPT effectively for sharpening listing copy and restructuring follow-ups to sound more persuasive.

It’s excellent for refining messaging and objection scripts before listing appointments. But it’s not tied to MLS data or transaction systems, so it should never replace pricing logic or CRM workflows.

It’s a communication enhancer, not an operational engine, and confidential data should never be pasted into it.

Advice: Use it to refine messaging, not to replace pricing analysis or CRM tasks. Never input confidential contract details.

In practice, Gemini works well for quick neighborhood research and summarizing broader market trends before client meetings.

It saves time when preparing contextual insights, especially for newer agents building confidence. That said, it doesn’t pull live MLS data or verified transaction-level numbers.

I treat it as a briefing tool, not a data authority, every client-facing insight still needs MLS validation.

Advice: Treat it as a research assistant. Validate data with MLS reports before presenting it to clients.

Zestimate is useful when opening seller conversations because it anchors expectations quickly.

I’ve used it as a reference point to guide pricing discussions. But AVMs vary heavily by micro-market accuracy. In competitive or unique property types, it can be significantly off.

It should always be paired with a proper CMA. It supports positioning, not pricing strategy.

Advice: Use Zestimate as a conversation starter, not a pricing authority. Always pair it with a Comparative Market Analysis (CMA). AVMs vary by market density.

For investors, Reonomy’s trial access is helpful for identifying ownership patterns and validating outreach targets.

I’ve used it to quickly filter portfolios before direct mail or off-market campaigns. But it’s not a full underwriting tool and doesn’t replace deeper financial modeling.

It’s strong for sourcing direction, not for final investment decisions.

Advice: Use it to validate leads before outreach. Scaling investor research requires paid access.

Free AI tools are safe when used for content and research, not when handling transaction-level data.

Best practice for brokerages:

For solo agents, free AI improves efficiency immediately.

For brokerages with 200+ agents, structured governance is essential.

Mashvisor is best for rental investors, DealMachine for off-market acquisition, and CoStar for institutional portfolio analytics.

In investor workflows, AI must answer three questions clearly:

Tools like HouseCanary, Mashvisor, DealMachine, and CoStar (with analytics layers) are commonly used because they combine property-level data, comparable sales, rent estimates, and ownership intelligence.

From deployments I’ve seen, AI improves investor decision speed significantly, but only when data inputs are reliable. Investor-grade AI depends on data accuracy far more than marketing-grade AI.

In institutional environments where I’ve seen HouseCanary deployed, its strength is forward-looking modeling, not just comps.

When acquisition strategy depends on projected appreciation and risk-adjusted pricing, it adds real value. But it’s not a quick-flip tool.

Smaller operators expecting instant deal clarity often find it too heavy. It performs best when paired with disciplined underwriting frameworks and long-horizon capital strategy.

Limitation: Not designed for small flippers looking for quick on-market deals; strongest when paired with institutional-grade decision processes.

Mashvisor works well as a screening layer. I’ve used it to quickly compare cap rates, rental yield scenarios, and short-term vs long-term performance before deeper underwriting. It speeds up deal triage significantly. However, for serious capital deployment, its assumptions need validation through detailed financial modeling. It accelerates filtering, but it doesn’t replace spreadsheet-level diligence.

Limitation: Relies on market-level assumptions; should not replace detailed underwriting spreadsheets for large capital deployments.

DealMachine shines when investors are consistently running outbound acquisition campaigns. In active off-market sourcing, its owner lookup and outreach automation streamline prospecting.

But results depend heavily on acquisition discipline. Without consistent follow-up and pipeline management, the tool doesn’t produce leverage.

It’s built for operators who execute daily, not passive analysts seeking portfolio modeling.

Limitation: Performance depends on acquisition discipline; it doesn’t model deep financial projections.

In multi-market portfolio environments, CoStar becomes strategic. I’ve seen it used effectively for rent trend analysis, absorption tracking, and macro-level allocation decisions.

It supports capital strategy, not just property selection. That said, for small investors or single-asset buyers, it’s often excessive and cost-heavy.

Its value compounds with scale, below that threshold, it’s overpowered.

Limitation: Expensive and often excessive for small investors; overpowered for single-property acquisitions.

| Tool | Best For | Underwriting Depth | Portfolio-Level Forecasting | Ideal Investor Type | Key Limitation |

|---|---|---|---|---|---|

| HouseCanary | Predictive valuation & appreciation modeling | High – forward-looking AVMs & market forecasts | Moderate | Institutional buyers & serious residential investors | Less practical for quick flips or small operators |

| Mashvisor | Rental ROI & cash-flow screening | Moderate – cap rate & rental modeling | Low–Moderate | Buy-and-hold & STR investors | Relies on market-level assumptions |

| DealMachine | Off-market property sourcing | Low – sourcing-focused, not deep financial modeling | Low | Active flippers & acquisition-driven investors | Limited portfolio analytics |

| CoStar (Analytics) | Institutional portfolio analytics | High – market data & benchmarking | Very High | Funds & multi-market operators | High cost, excessive for small investors |

If your brokerage is generating leads but struggling with routing, follow-ups, or MLS-triggered automation, it’s time to audit your AI stack.

Get a Real Estate AI Strategy SessionIf AI improves workflow efficiency, buy SaaS. If AI defines your competitive advantage, build custom.

The real question is control, differentiation, and long-term scalability. Below is a structured comparison based on how these decisions play out in real estate environments.

| Factor | SaaS AI Tools (Follow Up Boss, kvCORE, Lofty) | Custom AI Development |

|---|---|---|

| Deployment Speed | 2–8 weeks | 4–8 months |

| Upfront Cost | Low | High |

| Customization | Limited to vendor features | Fully customizable |

| MLS Integration | Pre-built connectors | API-based, fully controlled |

| Data Ownership | Vendor-hosted | Fully owned |

| Predictive Modeling | Generic models | Proprietary models |

| Scalability | License-based scaling | Infrastructure-based scaling |

| Competitive Advantage | Low differentiation | High differentiation |

| Maintenance | Vendor-managed | Internal / outsourced responsibility |

SaaS tools are optimized for speed and operational simplicity.

| Tool Type | Monthly Cost Range |

|---|---|

| Real Estate CRM AI (Follow Up Boss, Lofty) | $69–$999 per user/month |

| Enterprise CRM AI (Salesforce Einstein) | $150–$300+ per user/month |

| Lead Gen + AI Platforms (CINC, kvCORE) | $499–$3,000+/month depending on structure |

| Brokerage Size | Average Deployment Time |

|---|---|

| 50–150 agents | 2–4 weeks |

| 150–300 agents | 4–6 weeks |

| 300+ agents | 6–8 weeks |

Where SaaS Wins:

Where SaaS Breaks:

For most brokerages under 200 agents, SaaS is sufficient.

Custom AI becomes relevant when AI defines your operational edge, not just automates tasks.

| Layer | Components |

|---|---|

| Data Layer | MLS APIs, CRM data, transaction history |

| Processing Layer | Data pipelines, ETL workflows |

| AI Layer | Custom lead scoring, AVMs, forecasting models |

| Application Layer | Dashboards, automation triggers |

| Infrastructure | AWS / Azure / GCP cloud environment |

| Layer | Components |

|---|---|

| Data Layer | MLS APIs, CRM data, transaction history |

| Processing Layer | Data pipelines, ETL workflows |

| AI Layer | Custom lead scoring, AVMs, forecasting models |

| Application Layer | Dashboards, automation triggers |

| Infrastructure | AWS / Azure / GCP cloud environment |

| Scope | Budget Range | Timeline |

|---|---|---|

| Brokerage Automation Platform | $80k–$200k | 4–6 months |

| Investor Underwriting System | $150k–$400k | 5–8 months |

| PropTech SaaS Platform | $300k–$1M+ | 6–12 months |

Where Custom Wins:

Where Custom Hurts:

| If… | You Should… |

|---|---|

| AI improves workflow efficiency | Buy SaaS |

| AI defines your revenue engine | Build Custom |

| You operate under 200 agents | Buy SaaS |

| You manage institutional portfolios or multi-market data | Consider Custom |

| You need differentiation for funding or product positioning | Build |

| Company Type | Primary AI Need | Recommended Approach | Why This Works | What to Avoid |

|---|---|---|---|---|

| Solo Agents (1–20 agents) | Faster listing prep, basic follow-ups, lead organization | SaaS CRM + selective free AI tools | Low complexity, quick ROI, minimal technical overhead | Building custom AI or overpaying for enterprise platforms |

| Growing Brokerages (50–300 agents) | Lead routing, automation consistency, behavioral tracking | Real estate-native AI CRM (Follow Up Boss, kvCORE, Lofty) | Standardized workflows, MLS integration, scalable automation | Generic AI tools without CRM integration |

| Large Brokerages (300–1,000+ agents) | Multi-team routing, data governance, regional expansion | SaaS + custom AI layer | Combines operational stability with deeper customization | Relying purely on off-the-shelf AI with limited flexibility |

| Rental Property Investors | Cash flow modeling, cap rate analysis, deal screening | Mashvisor + underwriting validation | Fast deal filtering before deeper financial analysis | Using AVMs as final pricing authority |

| Institutional Investors / Funds | Portfolio forecasting, risk modeling, allocation strategy | CoStar analytics or custom AI underwriting | Portfolio-level visibility and strategic allocation control | Single-property tools without portfolio analytics |

| PropTech Startups | Product differentiation, proprietary AI logic | Custom AI development | Own the data, models, and long-term valuation upside | Building product on top of restrictive SaaS tools |

Most brokerages under 200 agents do not need custom AI.

The biggest risk is deploying AI without aligning it to workflows. Lead scoring without automated routing, or valuation models without reliable data inputs, often results in wasted investment and limited measurable impact.

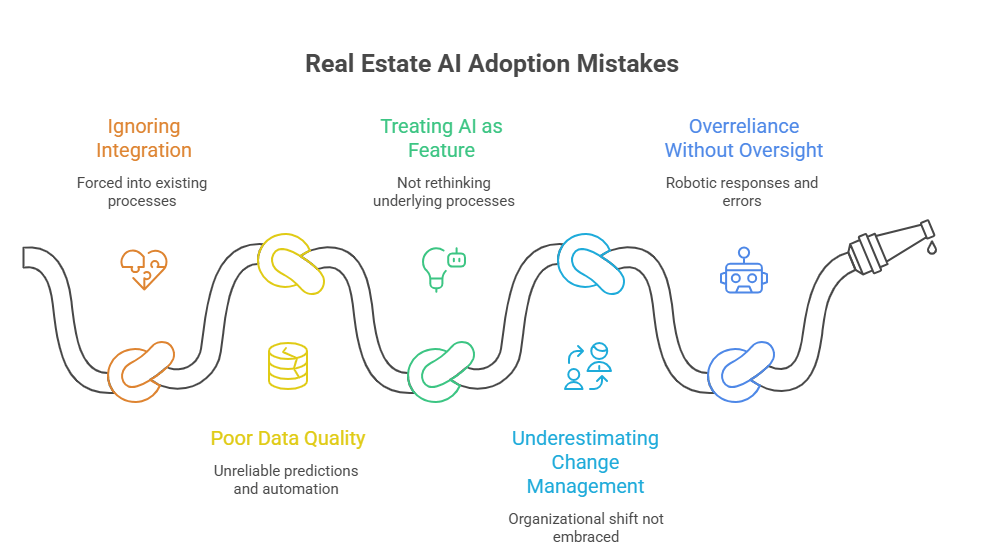

Even strong AI tools fail to deliver impact if implementation missteps aren’t avoided.

Across industries, data shows that most AI initiatives stall not because of the models, but because of how they’re deployed.

In real estate, many brokerages adopt AI thinking it’s plug-and-play. But broader research shows 95% of AI pilots fail to produce measurable business value when they’re forced into existing processes without alignment to workflows and KPIs. This is often due to minimal adaptation or governance strategies.

AI amplifies whatever it’s given. If CRM datasets are fragmented, outdated, or duplicated, AI predictions and automation outputs become unreliable, and decisions based on them undermine trust and performance.

Companies often deploy AI for lead scoring or content automation without rethinking the underlying process that needs optimization.

McKinsey finds that while 88% of organizations report regular AI use, only a minority are scaling it into meaningful business functions, largely due to failure to redesign workflows around the technology.

AI is not just a tech upgrade. It’s an organizational shift. A McKinsey report found that although almost all companies invest in AI, only ~1% feel they are mature on AI adoption, meaning they’ve embedded it across processes with measurable outcomes.

Over-automation with weak governance leads to robotic responses and decision errors that agents and investors later have to clean up, sometimes at a high time cost.

AppVerticals specializes in real estate software and AI development, helping brokerages, investors, and proptech startups build CRM-integrated automation platforms, underwriting engines, and scalable AI architectures tailored to their workflows.

Real estate companies should consider a custom AI development partner when SaaS tools no longer support their scale, MLS routing becomes complex, or proprietary underwriting and portfolio forecasting become competitive differentiators.

At this stage, integration depth matters more than features. CRM APIs, MLS normalization, automated lead routing logic, predictive valuation models, and cloud-based data pipelines must work as one system, not disconnected tools.

With expertise in MLS integrations, custom lead scoring systems, portfolio analytics, and cloud-native infrastructure, AppVerticals delivers real estate AI systems built for production scale, not experimental deployment.

If AI is central to your growth strategy, partnering with a team experienced in real estate data ecosystems becomes a strategic advantage.

The best AI tools for real estate agents and investors are those that integrate with CRM and MLS systems, automate high-impact workflows, and produce measurable ROI within months, not just impressive dashboards.

For brokerages under 200 agents, SaaS platforms usually deliver fast results. For institutional investors and proptech companies, proprietary AI can become a competitive advantage.

The key is matching the tool to your scale, data structure, and long-term strategy.

We’ll help you select, compare, or build the AI tools that align with your operational goals.

Talk to Real Estate AI SpecialistsDiscover how our team can help you transform your ideas into powerful Tech experiences.