About Us

Mobile app monetization is no longer experimental; it’s a $1.2 trillion global economy projected for 2026, with consumer spending on apps hitting ~$155.8 billion in 2025 and in‑app advertising generating ~$390 billion.

Developers and founders who treat monetization as product strategy from day one capture far more value than those who consider it an afterthought. This post distills the most important statistics every app maker must know in 2026, including revenue benchmarks, platform performance, and category-specific trends.

At AppVerticals, we work closely with founders and product teams to design monetization architectures that scale with user growth. The data in this report reflects both current industry benchmarks and patterns we consistently see across apps moving from launch to revenue optimization.

The mobile app market continues to scale rapidly, with both user spending and advertising dollars surging:

AppVerticals experts see in‑app purchase and subscription revenue extending its growth trajectory in 2026, following $167 billion in global IAP revenue in 2025 and rising overall app consumer spend of $155.8 billion.

iOS dominates revenue and ARPU, while Android dominates installs and ad-driven scale, making iOS ideal for premium monetization and Android essential for massive reach. Platform choice matters for revenue strategy:

| Metric | iOS | Android |

|---|---|---|

| Revenue share (global) | ~60–65% of total app revenue | ~35–40% of total app revenue |

| Install share (global) | ~30–40% of total installs | ~60–70% of total installs |

| User spend per user (general insight) | Higher spend per user (developers report iOS users outspend Android users) | Lower spend per user |

Insight: Prioritize iOS if subscription and high ARPU are critical early in your monetization journey; use Android for reach and ad-driven scale. At AppVerticals, platform sequencing is a major revenue lever. Many subscription-first apps launch on iOS to validate monetization, then expand to Android for broader acquisition and ad-driven scale.

Monetization only works if users stay engaged:

Locking in engagement early dramatically increases the pool of users who can be monetized, whether through ads, IAPs, or subscriptions.

Monetization isn’t a feature. It’s architecture. We design apps built for retention, scale, and predictable revenue from day one.

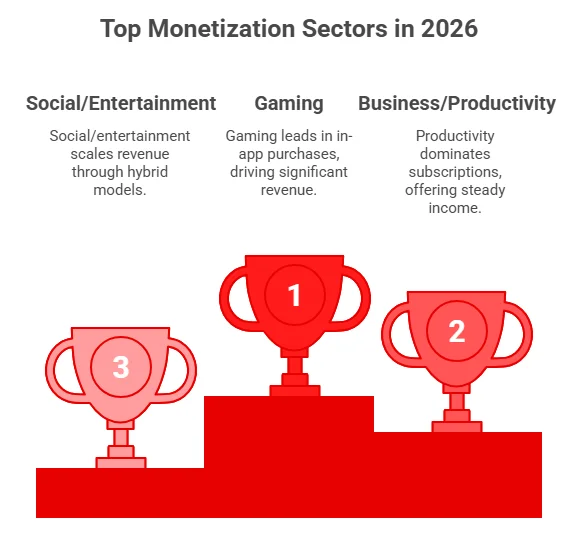

Gaming remains one of the most lucrative categories: in 2025, mobile games generated approximately $81.8 billion in IAP revenue, according to Sensor Tower’s State of Mobile 2026 report.

Industry forecasts suggest that the broader mobile gaming market, including advertising, IAP, subscriptions, and other revenue streams, is expected to grow significantly in the coming years, potentially reaching over $230 billion by 2030 as smartphone penetration, live‑ops engagement, and hybrid monetization strategies expand globally.

Games with diverse monetization features (rewarded ads, battle passes, skins) see the highest spending activity.

Business and productivity apps generally drive stronger conversions from free to paid models, thanks to clear ongoing value and premium features. According to ZipDo, in 2023, subscription-based apps generated $212 billion globally, with productivity apps among the top contributors.

Social and entertainment apps often combine ad‑driven revenue with optional premium tiers, striking a balance between massive free reach and subscription monetization (market trend: hybrid outcomes).

Monetization Insights: While these patterns are common in social apps, our mobile app development experience at AppVerticals shows that revenue success depends less on app category and more on how clearly value is communicated from the first user interaction.

When a monetization strategy is built directly into the product architecture and aligned with core user motivation, even non-traditional apps can outperform industry benchmarks. This makes early development decisions critical for long-term revenue performance.

Mobile app revenue in 2026 ranges from $10 per month for small apps to $10M+ per month for apps with 1M+ MAU, depending on monetization architecture, retention, engagement depth, and ARPU.

Revenue does not scale linearly with downloads; it scales with monetization design.

| App Scale | Typical Monthly Revenue Range |

|---|---|

| 1,000 downloads | ~$10 – $100+ (ad-heavy or low ARPU) |

| 10,000 downloads | ~$300 – $2,000 (freemium + ads) |

| 100,000 MAU | ~$5,000 – $100,000+ (hybrid monetization) |

| 1M+ MAU | ~$500,000 – $10M+ (optimized monetization) |

These ranges show one clear pattern: monetization architecture matters more than raw downloads.

At AppVerticals, we consistently help founders shift focus from “how many installs?” to:

Those are the real drivers behind these benchmarks.

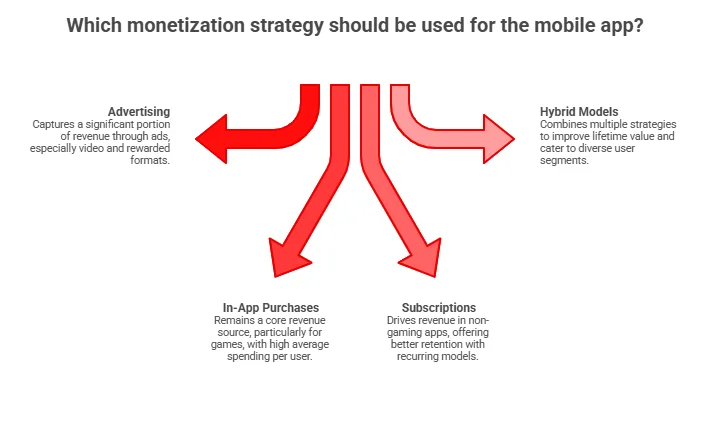

Different monetization models produce vastly different revenue outcomes depending on category, engagement depth, and user intent.

At AppVerticals, we rarely recommend single-stream monetization unless the product is highly niche. Hybrid systems allow apps to monetize:

Without compromising user experience.

Expert Opinion

App monetization is moving away from static paywalls and flat subscriptions toward intelligent, outcome-aligned value exchange. Today, successful apps tie revenue directly to measurable results by charging per usage, per outcome, or per performance metric rather than for vague access.

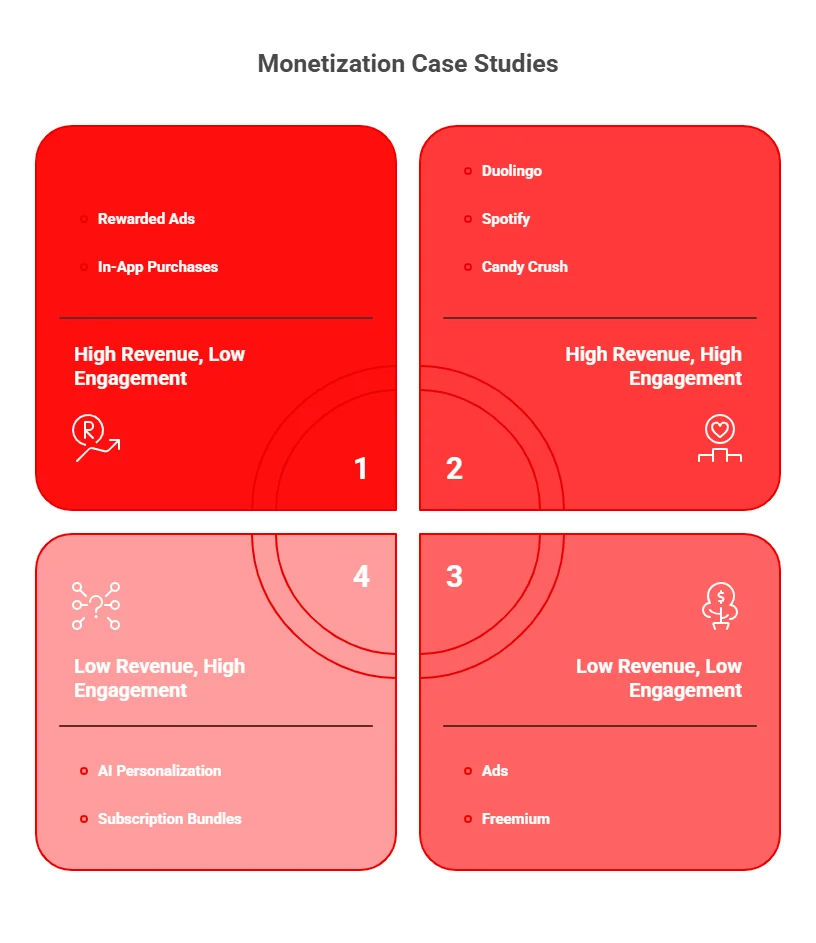

For example, Duolingo blends freemium access with Super subscriptions and microtransactions like streak freezes, monetizing engagement rather than forcing upfront payment. OpenAI prices API access based on usage, directly aligning revenue with compute consumption. Canva layers free access with Pro subscriptions and paid asset libraries, creating a hybrid monetization stack instead of a single paywall.

We’re also seeing marketplace-driven models like Shopify, which combines subscription tiers with revenue share and embedded payments. Monetization is no longer a pricing-page decision; it’s a product design decision embedded into discovery, experimentation, and behavioral strategy.

Core Takeaway: In 2026, successful apps don’t ask “How do we charge?” They ask, “Where does value naturally occur in the user journey?” Revenue follows architecture, not installs.

Top app monetization trends in 2026 include hybrid revenue models, AI-driven personalization, rewarded ads, subscription growth, and premium AI features, all focused on maximizing retention, conversions, and lifetime value.

In enterprise contexts, AI personalization can boost conversion by ~18 % and cut churn by up to ~15 %. Personalized pricing and offer recommendations further drive 10–30 % higher ARPU by matching offers to user behavior at the right moment. These outcomes confirm that AI not only increases engagement:*

Expert Opinion

AI-generated code does not emerge from creativity. It emerges from patterns. When insecure patterns appear in training data, they are not copied once. They are reproduced thousands of times across unrelated applications. What used to be isolated developer mistakes can become systemic weaknesses. This does not mean AI should be avoided. Used correctly, AI is an extraordinary tool. But security cannot be automated by generation alone. Growth is inevitable. Resilience is a choice

Several leading apps illustrate how these trends perform in practice:

App monetization in 2026 is no longer a post-launch decision; it’s a product architecture discipline that directly drives revenue and long-term growth. Key metrics we see at AppVerticals:

| Metric Category | 2026 Benchmark / Data Point |

|---|---|

| Hybrid Monetization LTV Impact | ~30% higher LTV vs single-revenue models |

| iOS Share of Global App Revenue | 60–65% |

| Android Share of Global Installs | 60–70% |

| Average Spend per App (iOS) | ~$12.77 |

| Average Spend per App (Android) | ~$6.19 |

| Average 30-Day Retention (All Apps) | ~27% |

| Retention-Optimized Growth Impact | 2–3× increase in monetizable users |

| Gaming IAP Revenue (2025) | ~$81.8B |

| Gaming Revenue Projection (2030) | $230B+ |

| Productivity App Subscription Adoption | ~30% monthly subscriber base |

| Global Subscription App Revenue (2023 baseline) | $212B |

| Hybrid Monetization ARPU Lift (Social/Streaming) | +10–25% |

| AI-Powered Conversion Lift | +15–25% |

| AI-Powered Engagement Lift | ~62% |

| AI-Powered ARPU Increase | +10–30% |

| First-Party Data Ad Revenue Impact | Up to 2× higher ad revenue |

| Web-to-App Monetization ARPU Increase | ~15% |

Discover how our team can help you transform your ideas into powerful Tech experiences.