About Us

The AI chatbot market has moved beyond experimentation, growing at a 23.3% CAGR from $7.76B in 2024 to $27.29B by 2030. Demand is rising for chatbots embedded in apps and digital platforms that deliver instant, intelligent interactions.

In 2026, chatbots go beyond FAQs, enabling task execution, workflow automation, and system-level actions. For executives, the focus is no longer adoption, but rapid deployment to boost revenue, cut costs, and ensure compliant scale.

AI chatbot growth is being fueled by three converging forces: market demand for instant service, enterprise pressure to show measurable ROI, and rapid advances in LLM-powered automation.

A projected 23.3% CAGR through 2030 places AI chatbots among the fastest-growing enterprise technologies. Unlike traditional SaaS tools, chatbot deployments touch multiple high-impact business areas simultaneously: customer support, sales, lead generation, compliance, and internal operations.

The scale of impact is what makes this market impossible to ignore: AI chatbots directly influence conversion rates, cost-per-call, customer wait times, and compliance risk, all of which sit squarely on executive dashboards.

| Industry | Primary Use Cases & Benefits | Adoption Level / Stats |

|---|---|---|

| Banking & Financial Services | Account inquiries, fraud alerts, and digital support | ~83–92% adoption in many banks; handling large inquiry volumes and lowering support load |

| E-Commerce & Retail | Product recommendations, order tracking, and customer service | ~79% adoption; major driver of purchase flows |

| Telecommunications | Billing, technical support, service queries | ~76% adoption, fast real-time issue handling |

| Travel & Hospitality | Booking support, itinerary management | ~71% adoption; peak-period efficiency |

| Healthcare | Appointment scheduling, patient support | ~64–66% adoption; admin task automation |

| Insurance | Claims queries, policy Q&A | ~68% adoption; improves customer experience |

| Software / SaaS / Tech Support | Onboarding help, tech support, and FAQ automation | ~81% adoption in tech/SaaS companies |

Legacy rule-based chatbots in apps often underperform. Less than 12% of conversations ever lead to successful outcomes, and most interactions require human hand-offs.

AI chatbots powered by LLMs overcome these limits by understanding user intent and executing multi-step workflows autonomously, from rebooking tickets to processing refunds and updating app databases, while reducing average handle time by 30%.

This evolution from scripted responses to intelligent AI chatbots is driving adoption in mobile and web apps, improving user engagement, satisfaction, and operational efficiency. At AppVerticals, we help businesses modernize legacy chatbot systems into intelligent, LLM-powered solutions, ensuring smoother workflows, higher engagement, and measurable ROI

AppVerticals’ data highlights that 51% of consumers prefer bots over humans, 73% of mobile users expect in-app chat, and 82% expect zero-wait response

In response, product-led growth (PLG) SaaS companies are embedding chatbots directly into onboarding and activation flows, reducing trial-to-paid churn by 18%.

AppVerticals’ research and industry insights show that worker access to AI tools increased by 50% in 2025, while the share of AI projects operating in production environments at 40% or higher is expected to double within six months.

As a result, boards and leadership teams are no longer funding experiments. Capital is being allocated to AI chatbot platforms that can scale from MVP to audited, compliant production environments without requiring re-architecture, accelerating enterprise-wide adoption in apps and digital platforms.

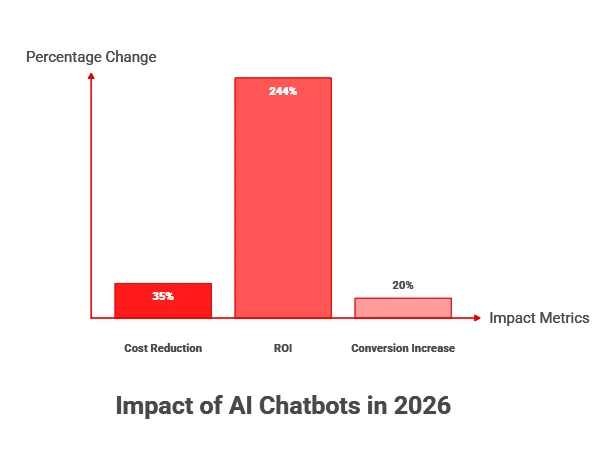

AppVerticals’ insights: In 2026, AI chatbots reduce customer support costs by up to 30–40% and deliver 148–340% ROI, while increasing conversions by 10–30% through real-time, intent-driven app interactions.

This is why forward-thinking business owners and founders are increasingly opting for AI development, turning chatbots and automation into tangible revenue and efficiency gains

| Metric | Before Bot | With Agentic Bot |

|---|---|---|

| Average conversion rate | 2.1% | 6.3% |

| Average order value | $68 | $92 (+35%) |

| Sales uplift | — | +67% |

| Cart recovery | 8% | 31% |

In financial services:

This reduces the cost per sales-qualified lead from $84 to $31, a 63% efficiency gain that directly impacts CAC and revenue velocity.

AppVerticals’ research indicates that Meta AI leads in reported active users, but ChatGPT outperforms in traffic depth and engagement, suggesting stronger cross-platform usage across consumer, enterprise, and API environments. Rapid growth from challengers like Gemini is further fragmenting the AI chatbot ecosystem.

| Platform | Usage / Share Indicator | Strength |

|---|---|---|

| ChatGPT (OpenAI) | Dominant web traffic leading with ~80%+ share of AI chat usage in some measures | Best general conversation, broad tasking, enterprise API use |

| ChatGPT (usage stats) | ~2.5 billion messages/day (Oct 2025) | Massive global engagement |

| Meta AI | Ranked #1 by some user counts with ~500 million active users (2025) | Deep integrative reach across WhatsApp/IG/Facebook |

| Google Gemini | Growing rapidly, with significant usage; estimates range from mid-hundreds of millions of monthly visits and a growing share | Integration with the Google ecosystem |

| Microsoft Copilot | ~3.58–4.05% global AI chatbot market share (2025) | Strong enterprise and Bing integration |

| Grok | Fast-growing emerging chatbot with notable YoY growth | Fast-growing rival, tied to the X platform ecosystem and niche user engagement |

| Perplexity | Significant second-tier platform with ~10–11% share in market share estimates and growing usage. | Research-centric chatbot with strong answer accuracy and niche audiences |

| Claude | Smaller share (usually ~1% or slightly above), but rising research/workflow adoption. | Focus on reasoning depth, enterprise contexts, and niche knowledge tasks |

AppVerticals’ market insights indicate that AI chatbots are evolving from simple conversational tools into embedded intelligence layers inside apps and enterprise platforms. In 2026, the focus is no longer on how well chatbots respond, but on how effectively they retain context, personalize interactions, and integrate with core systems like CRMs and analytics tools.

The next phase centers on deeper automation, multimodal interaction, and governance at scale. AI chatbots are increasingly expected to connect across workflows, support voice and visual inputs, and operate within compliance-ready frameworks, turning conversations into measurable business actions and insights rather than isolated support events.

Adoption is particularly strong in sectors where real-time customer interaction and automation drive measurable ROI:

Key market trends shaping adoption in 2026 include:

According to AppVerticals, businesses that adopt AI chatbots strategically, integrating them deeply into apps and workflows while ensuring compliance, are positioned to outperform competitors, turning conversational AI into a core driver of revenue, efficiency, and user satisfaction.

Leverage our generative AI expertise to build intelligent chatbots, automate workflows, and enhance user engagement—fully integrated and compliant.

By 2027, 58% of companies will merge chatbots with physical AI systems such as robotics, drones, and industrial sensors.

Based on current adoption and growth trends:

Predicted future scenario: Based on market analysis and ongoing enterprise research, AppVerticals identifies a clear shift toward AI market fragmentation by 2027. Multiple AI agents will coexist, some purpose-built for enterprise task execution and workflow automation, while others will focus on consumer engagement, conversational experiences, and content interaction. Rather than a single dominant AI interface, businesses will deploy specialized agents optimized for distinct use cases across operations, customer experience, and digital products.

The data is unambiguous:

23.3%

Market CAGR

148–200%

First-Year ROI

80%

FAQ Deflection

67%

Sales Uplift

Yet boards don’t fund technology; they fund outcomes. AI chatbots succeed only when deployed against measurable friction points: conversion loss, churn, cost-per-call, or compliance exposure. Solve those problems, and budgets unlock quickly.

Solve them at scale, and organizations position themselves ahead of the next enterprise AI S-curve.

Discover how our team can help you transform your ideas into powerful Tech experiences.