About Us

Having worked on fintech apps that both failed and scaled, I’ve seen that success comes from strong banking partnerships, trust-first infrastructure, and smart monetization timing, the same approach Zelle follows. At AppVerticals, we’ve helped founders redesign fintech products around these exact principles.

Zelle moves hundreds of billions annually while staying free for users, making it a powerful case study in modern fintech strategy. This guide breaks down how Zelle makes money and the key lessons founders and investors should apply, from institutional monetization and embedded finance to security-driven growth and scalable product design.

Zelle isn’t simply a standalone fintech app. It’s a bank-backed payment network operated by Early Warning Services, a company owned by major U.S. banks including JPMorgan Chase, Bank of America, and Wells Fargo.

That structure changes everything about monetization. Instead of competing with banks, Zelle strengthens them, embedding payments directly into their apps and ecosystems.

Zelle’s deep integration with banks lets users pay directly from their accounts, cutting acquisition costs, building trust, and reducing friction.

| Zelle Distribution Advantage | What It Means in Practice | Fintech Problem It Solves |

|---|---|---|

| Integrated with thousands of U.S. financial institutions | Built into existing banking ecosystems from day one | Reduces customer acquisition costs |

| Embedded directly into banking apps | Users access payments without downloading a new app | Eliminates trust barriers |

| Connected to existing bank accounts | No need for external wallets or onboarding friction | Minimizes payment friction |

At AppVerticals, I’ve seen fintech adoption increase dramatically once payment functionality was integrated into existing financial ecosystems instead of relying solely on standalone apps.

As adoption accelerates, companies increasingly partner with experienced teams offering fintech app development services to build secure, bank-integrated payment ecosystems.

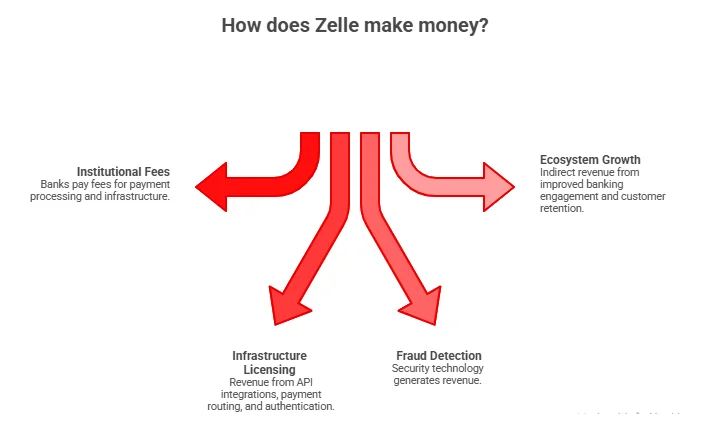

So, how does Zelle make money? Zelle’s primary revenue streams come from:

Early Warning Services earns revenue by charging participating financial institutions small transaction-related fees rather than charging consumers directly.

“It is operated by Early Warning Services, a fintech co-owned by JPMorgan Chase (the nation’s largest bank), Bank of America, Capital One, PNC Bank, Truist, U.S. Bank, and Wells Fargo. Early Warning Services charges its thousands of financial institution partners a small fee for each Zelle transaction.”

This model aligns incentives with banks while keeping the product free for users, a critical growth strategy. With AppVerticals, you can also leverage these proven infrastructure-first strategies to build secure, bank-integrated fintech apps that scale without relying on user fees.

Turn your payment ideas into secure, scalable platforms like Zelle. Leverage AppVerticals’ expertise in mobile app development, real-time payment rails, and embedded finance.

High transaction volume is the backbone of Zelle’s monetization. Zelle has processed hundreds of billions in annual payment volume, enabling:

Banks benefit from Zelle through:

That value justifies institutional payments to Zelle, reinforcing the network’s revenue model.

Let’s break down Zelle’s monetization structure in practical terms that founders can apply.

Banks pay small fees for payment processing and infrastructure access.

Revenue comes from:

Security is a revenue driver, not just a compliance requirement.

Indirect revenue includes:

“The most successful fintech platforms monetize infrastructure rather than end users.”

Security is the hidden engine driving Zelle’s rapid growth, ensuring users can send and receive money with complete confidence.

Key trust features include bank-level encryption to protect sensitive data, account verification to confirm identities, behavioral fraud monitoring to detect unusual activity, and real-time risk scoring to prevent threats before they impact transactions.

Together, these measures create a seamless and secure payment experience that users can rely on every time. As per AppVerticals insights, fintech apps that invest early in fraud detection achieve:

Zelle typically has no processing fee for business (merchant) payments, while Venmo and Cash App charge around 2–3% per transaction for business use.

In practical terms, if a customer pays a business 100 dollars:

Zelle’s 0% fee comes with fewer merchant tools: no card payments, no integrated checkout, limited invoicing, and no formal dispute framework, so it fits best for trusted, relationship‑based payments (e.g., rent, consulting, B2B).

Venmo and Cash App charge higher merchant fees but provide more consumer‑friendly flows (QR codes, app‑based discovery, basic dispute processes) and better support for casual or retail‑style sales.

| Aspect | Zelle (Business Use) | Venmo Business Profile | Cash App for Business |

|---|---|---|---|

| Typical processing fee | 0% (bank may vary) | 1.9% + $0.10 per transaction | 2.75% flat per transaction |

| Where money lands | Direct to bank account | Venmo balance, then transfer to bank | Cash App balance, then transfer |

| Card payments | Not supported | Via app and QR, no 3% card fee to buyer for biz payments | Via app and QR/$Cashtag |

| Disputes/chargebacks | Essentially none; payments final | Basic in‑app mediation | Basic refund flow |

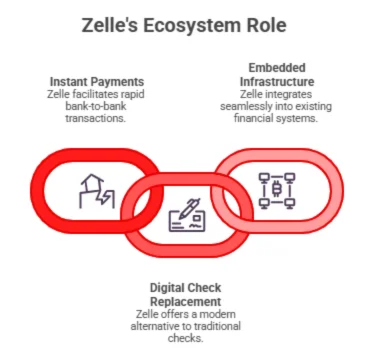

Rather than competing with banks, Zelle strengthens their digital transformation efforts. This strategic positioning is a major reason it scales without massive marketing spend. Zelle’s ecosystem role is distinct:

Zelle’s primary function is fast, bank-to-bank digital payments, allowing users to send and receive money directly from their existing bank accounts with built-in security and minimal friction, without needing a separate wallet or balance.

Users send funds directly between bank accounts in minutes, a technically complex feature involving real-time payment rails.

Unlike standalone digital wallets, Zelle eliminates extra steps that often slow down adoption. It doesn’t require a separate funding account, comes with built-in identity verification, and significantly reduces onboarding friction, making it easier and faster for users to start sending and receiving money directly from their existing bank accounts.

Core features founders must consider:

Through years of building and scaling fintech products as part of our mobile app development projects at AppVerticals, these have become non-negotiable:

At AppVerticals, we help founders turn fintech ideas into secure, revenue-generating platforms by combining strategic consulting, engineering expertise, and real-world fintech execution experience.

AppVerticals helps founders:

We implement:

Our fintech platforms include:

We design:

Our experience building fintech products, including rebuilding failing apps, gives founders practical, battle-tested insights.

Early focus on network effects, substantial investment in fraud prevention, and optimizing for institutional partnerships further strengthen growth and adoption, creating a resilient and scalable financial platform.

When founders ask how does Zelle make money, they’re really asking how to build a fintech platform that scales without relying on user fees. Zelle’s success comes from:

At AppVerticals, we help founders apply these lessons to build fintech products that are technically sound, investor-ready, and designed for long-term growth. Understanding Zelle’s model isn’t just about revenue; it’s about building fintech ecosystems that scale with trust and strategic infrastructure.

Discover how our team can help you transform your ideas into powerful Tech experiences.